Nick Brown MP MP for Newcastle upon Tyne East

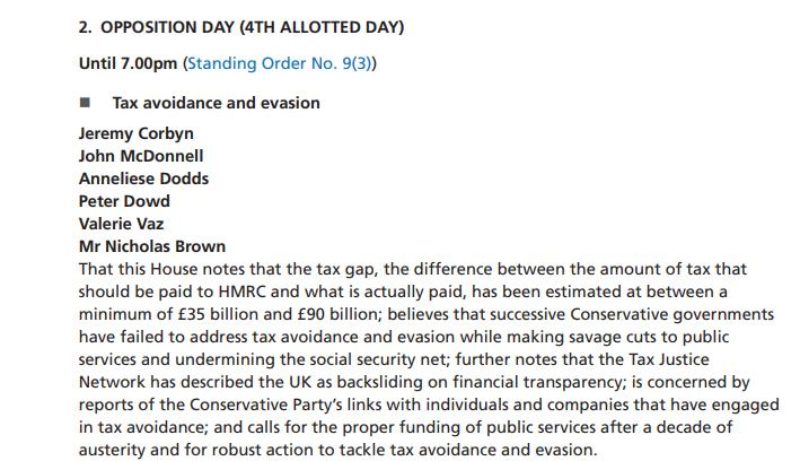

I co-sponsored an Opposition Day motion on tax and avoidance and evasion. Consecutive Conservative Governments have failed to tackle tax avoidance and evasion leaving the UK with a deeply unfair and unequal tax system. This has led to a situation where multinational companies and wealthy individuals engage in aggressive tax avoidance and evasion schemes. As a result, the UK is missing out on billions of pounds worth of potential investment in our public services and infrastructure.

Five of the biggest US technology firms paid just £237m in UK corporation tax in 2018 despite generating more than £8billion in profits between them. This included Apple paying £71m for its three UK businesses, Microsoft paying £24.7m, Facebook £30m, Google £73m and Cisco £40m.

The Labour Party supports proposing a fair tax programme to root out tax evasion and clamp down on tax havens. This involves a public register of trusts, a public filing of tax returns for large companies and wealthy individuals, action on tax avoidance and evasion in Crown Dependencies and Overseas Territories and reversing cuts so that HMRC is properly resourced.